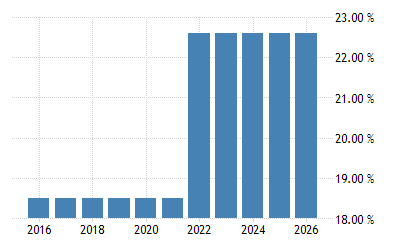

social security tax rate 2021

IRS Tax Tip 2022-22 February 9 2022 A. A Amount of Social Security or Railroad Retirement Benefits.

What Is The Maximum Social Security Tax In 2021 Is There A Social Security Tax Cap As Usa

Thus the most an individual employee can pay this year is 9114 Most workers.

. Those who are self-employed are liable. As of 2021 that amount increased to 65 percent and in 2022 the. The rate consists of two parts.

The tax rate for an employees portion of the Social Security tax is 62 so thats a pretty good savings for higher-income workers. Single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security payments for the 2021 tax year which you will file in. This is the rate at which tax was withheld from 85 of your benefits.

Half this tax is paid by. File a federal tax return as an individual and your combined income. B One-half of amount on line A.

For married couples filing jointly you will pay taxes on up to 50 of your Social Security income if you have a combined income of 32000 to 44000. Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021. Please call us at 1-800-772-1213 TTY 1-800-325-0778.

124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. For 2021 the first 142800 of your. 1200 sent in April 2020.

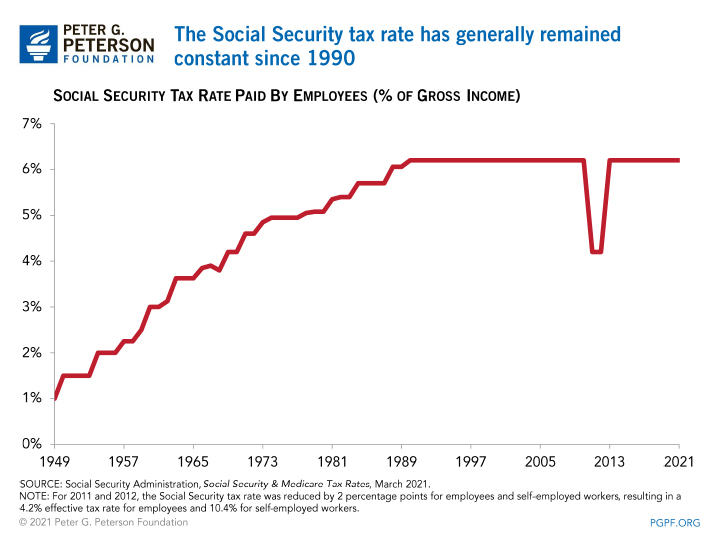

E Credit or refunds of certain Federal. For both 2021 and 2022 the Social Security tax rate for employees and employers is 62 of employee compensation for a total of 124. Enhanced child tax credit.

If tax was withheld at more than one rate during the year the percentage shown will be the tax rate in December 2021. The current rate for. For example an employee who earns 165000 in 2023 will pay 9932 in.

Any income you earn beyond the wage cap amount is not subject to a 62 Social Security payroll tax. The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits. The employers Social Security payroll tax rate for 2021 January 1 through December 31 2021 is the same as the employees Social Security payroll tax.

IRS Tax Tip 2021-66 May 12 2021 Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. The maximum amount of Social Security tax an employee will have withheld from their paycheck in 2023 will be 9932 147000 x 62 and 9114 147000 x 62 in year. Social Security taxes in 2022 are 62 percent of gross wages up to 147000.

Many forms must be completed only by a Social Security Representative. Exempt amounts under the retirement earnings test 2021 in dollars Age of retired person in 2021. Under FRA 1 for 2 withholding.

Worksheet to Determine if Benefits May Be Taxable. 62 of each employees first. As of 2021 a single rate of 124 is applied to all wages and self-employment income earned by a worker up to a maximum dollar limit of 142800.

A In general Section 6413 of the Internal Revenue Code of 1986 is amended by adding at the end the following new subsection. Social Security and Medicare Withholding Rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. For example if you make 80000 per year you pay Social Security taxes on all of your income so whether the limit is 130000 300000 or removed entirely it doesnt affect.

If you have a combined. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. Beginning in tax year 2020 the state exempted 35 percent of benefits for qualifying taxpayers.

Your employer also pays 62 on any taxable. The form you are looking for is not available online.

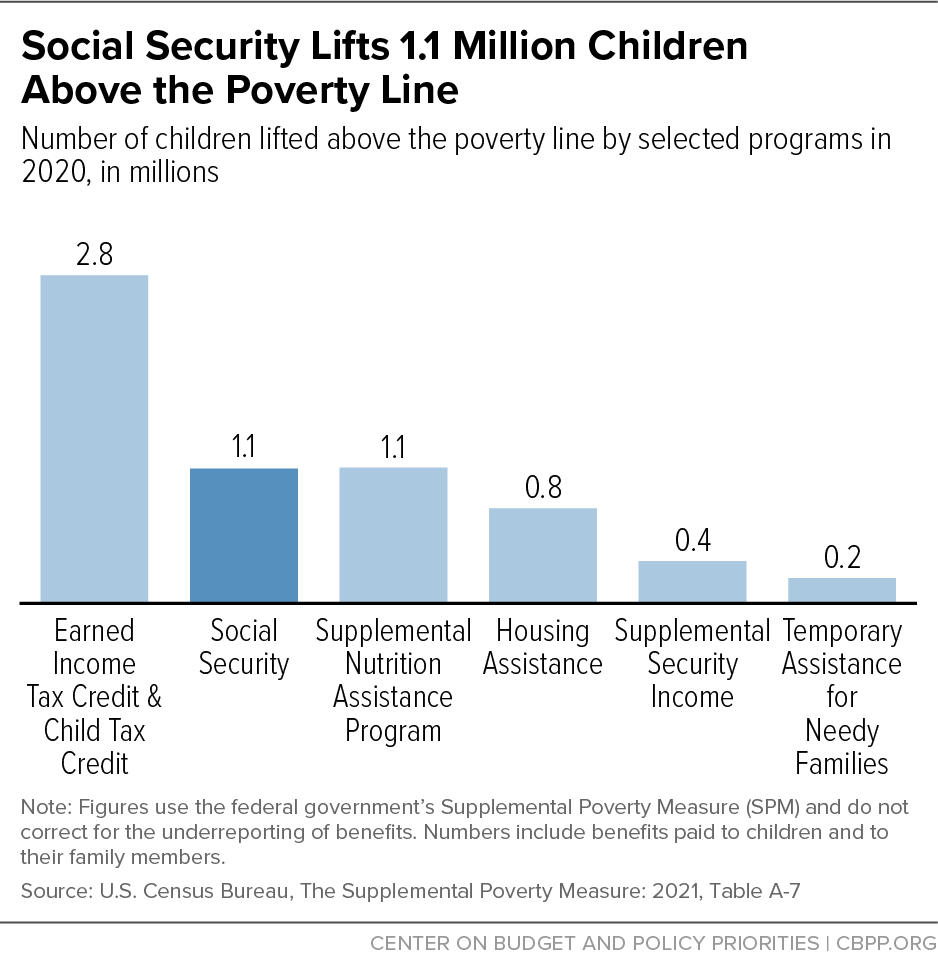

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

Maximum Taxable Income Amount For Social Security Tax Fica

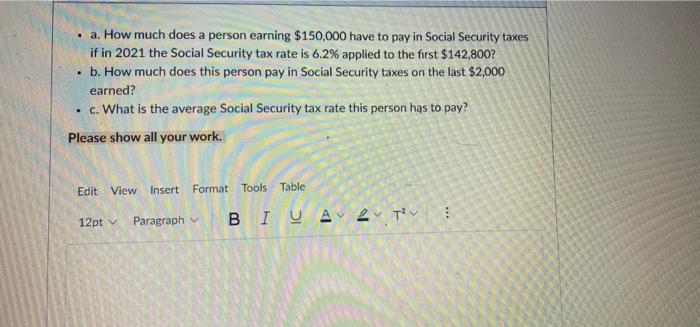

Solved A How Much Does A Person Earning 150 000 Have To Chegg Com

Hike Of Social Security S Taxable Wage Base Gets Renewed Attention Don T Mess With Taxes

The 2021 Social Security Wage Base Is Increasing Mlr

How Do Us Taxes Compare Internationally Tax Policy Center

Fica Tax Guide 2022 Payroll Tax Rates Definition Smartasset

Marginal Tax Rate Definition Taxedu Tax Foundation

:max_bytes(150000):strip_icc()/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

Will Your Planned Retirement Income Be Enough After Taxes Brady Martz Associates

The Taxation Of Social Security Benefits Congressional Budget Office

Federal Income Tax Brackets For 2022 And 2023 The College Investor

What Is The Social Security Wage Base 2022 Taxable Limit

2022 Federal Payroll Tax Rates Abacus Payroll

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

Social Security Tax Impact Calculator Bogleheads

Social Security Benefits Increase In 2021 Integrated Tax Services